Abstract:

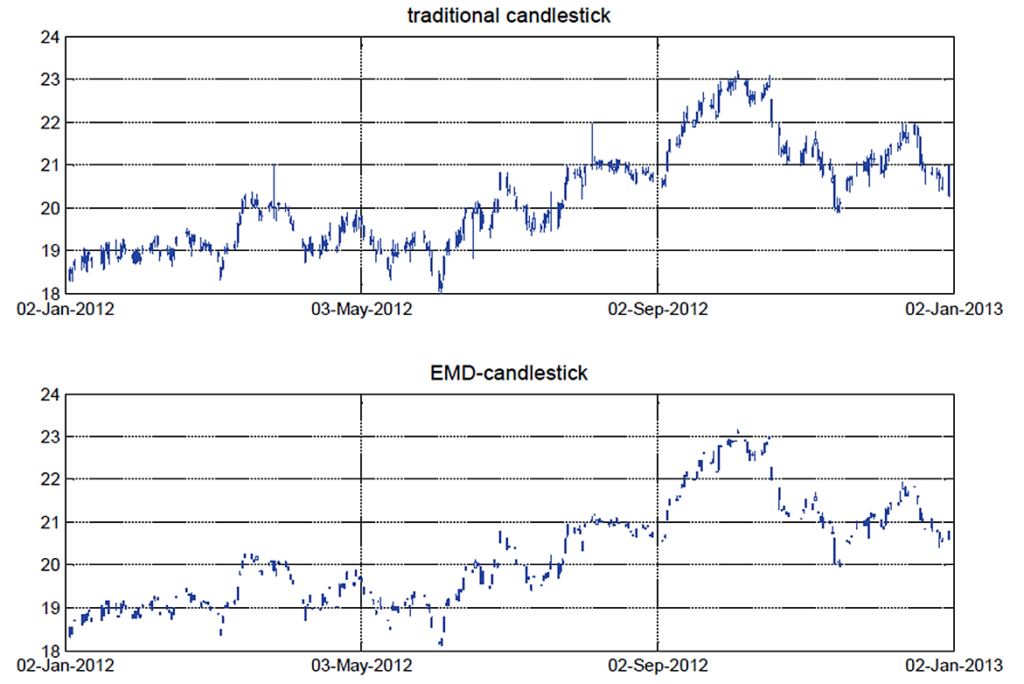

The project proposes an application of EMD to clean up the intraday market datas and form EMD-candlestick to replace traditional candlestick as the signal generators in technical trading strategies, including moving average, relative strength index, and intraday and interday trading rules. Empirical results show that technical trading strategies are more profitable if EMD-candlestick is used than if the traditional candlestick is used.

Problem to be solved:

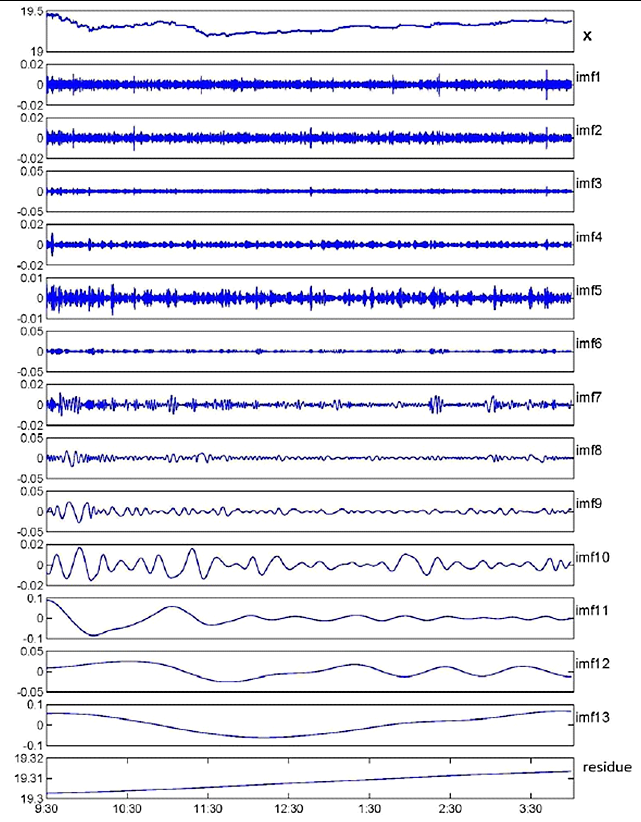

The candlestick essentially is a summary of the daily performance of the underlying stock and is completely determined by the open price, close price, daily high, and daily low. Most technical analysis tools use it as a building block. However, the noise within the intraday level may affect the use of the four prices as a summary. Therefore, we employ the EMD methodology to separate the information from the noise on intraday level data to construct the EMD-candlestick which can generate more profitable technical trading strategies.

Applications:

The EMD-candlestick could serve as a replacement of the traditional candlestick in a wide range of financial data analysis.

Target Users:

Financial practitioners / Algo-Traders / Investors

Uniqueness and Competitive Advantages:

Firstly, the EMD allows for local extraction of information and makes no assumption about linearity or stationarity as the classic Fourier analysis does. Secondly, intrinsic time scales of the data are used in the decomposition. Each resulting component has different average frequency and is defined by the amplitude variations in the original time series. Therefore, the EMD is an ideal data-adaptive tool to decompose real-time data and retrieve its frequency components that have actual physical significance.