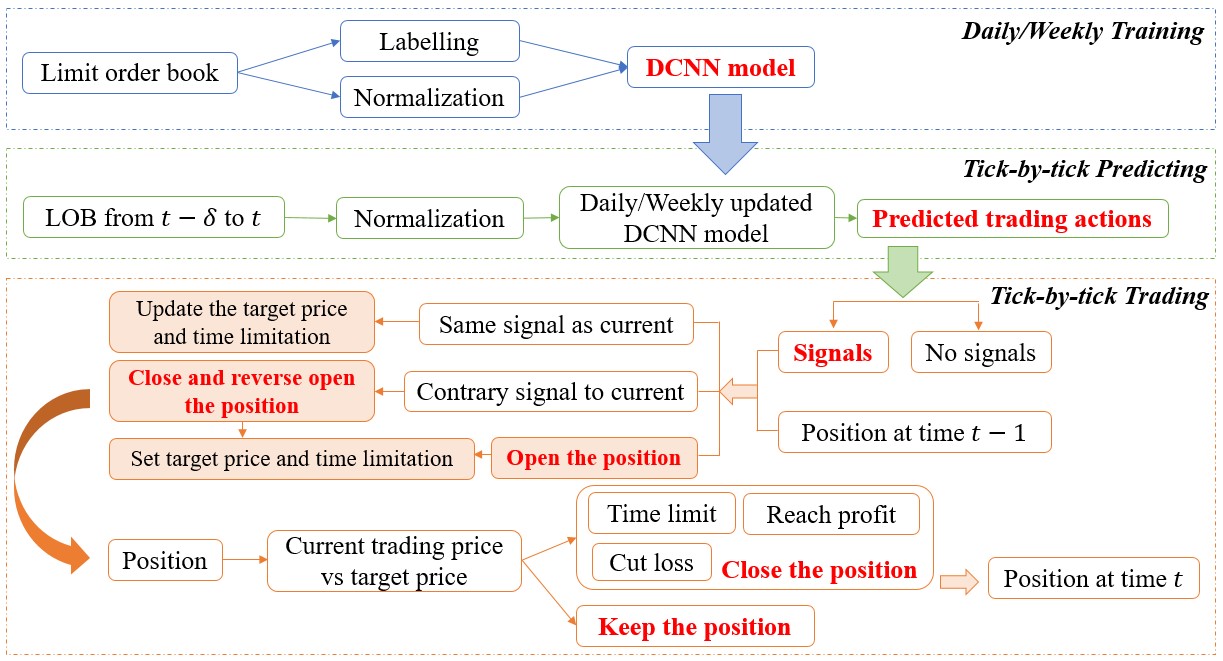

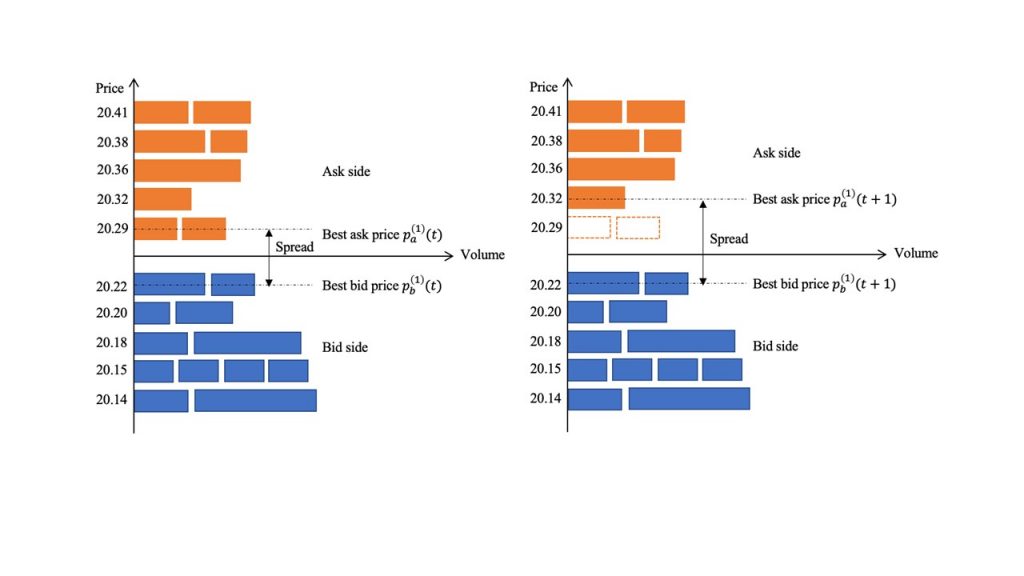

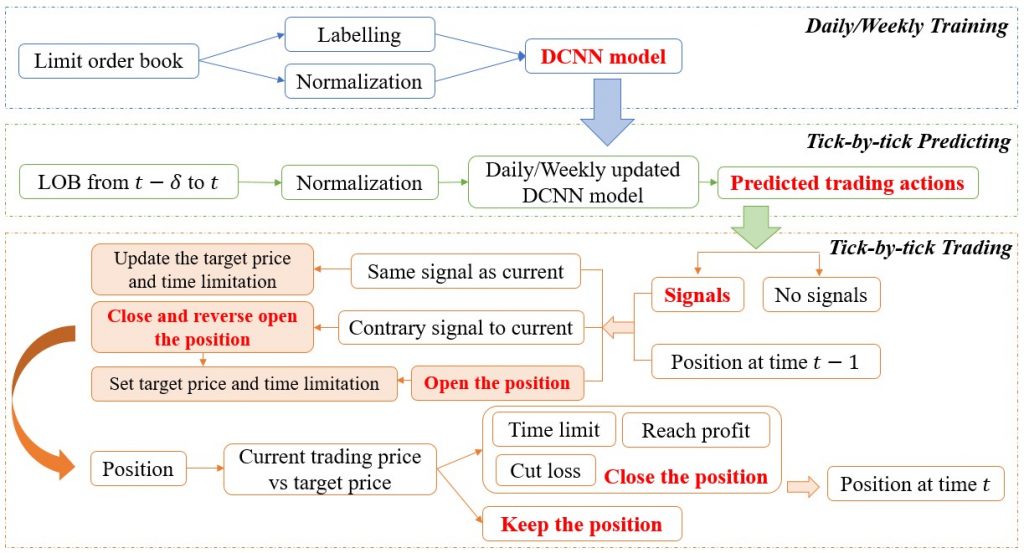

For intraday trading, we develop a novel deep limit order book (LOB) trading system that takes advantage of tick-time intervals with deep learning and GPU techniques to generate trading signals, optimize the use of signals and execute orders to gain profits under real trading circumstances. For interday trading, we build numerous factors, propose deep-learning models to predict trading signals and construct portfolios to achieve outstanding performance.

Uniqueness and Competitive Advantages:

- Our model is able to deal with large and high dimensional data sets by deep learning and GPU techniques, extract useful factors and predict stock movements

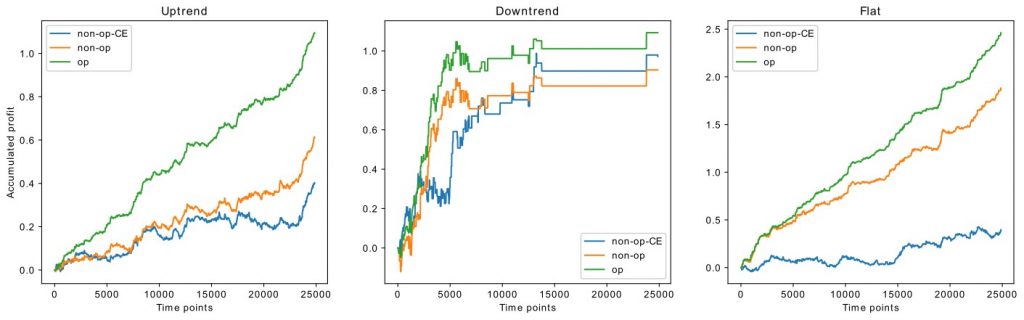

- Use focal loss function to handle imbalanced classification problem, as more long/short signals are detected, and profits are improved

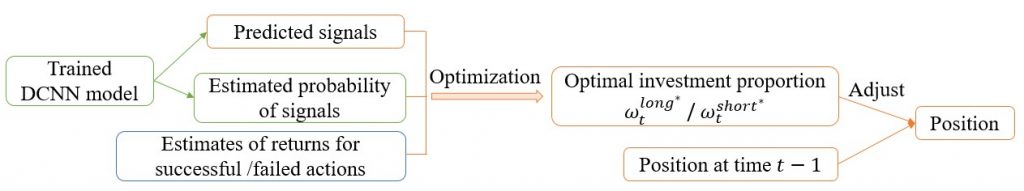

- Use the fractional Kelly growth criterion under VaR control to make use of the strength of signals and allocate the investment better

- Evaluate the significance of different features in the machine learning model, so as to explain the reasons why the machine learning models work

- Both accuracy of predictions and profits of trading can outperform traditional models